Finding the revenue to meet the critical needs of street conditions, affordable housing, transit and public safety is the most urgent issue for City leaders as the annual budget-setting process begins.

City government is funded by a variety of revenue sources, some of which can only be spent on services and others that can only be spent on specific infrastructure projects.

The challenge is to find a balanced mix of taxes and fees that can adequately fund services for a growing City, while not overburdening residents and taxpayers.

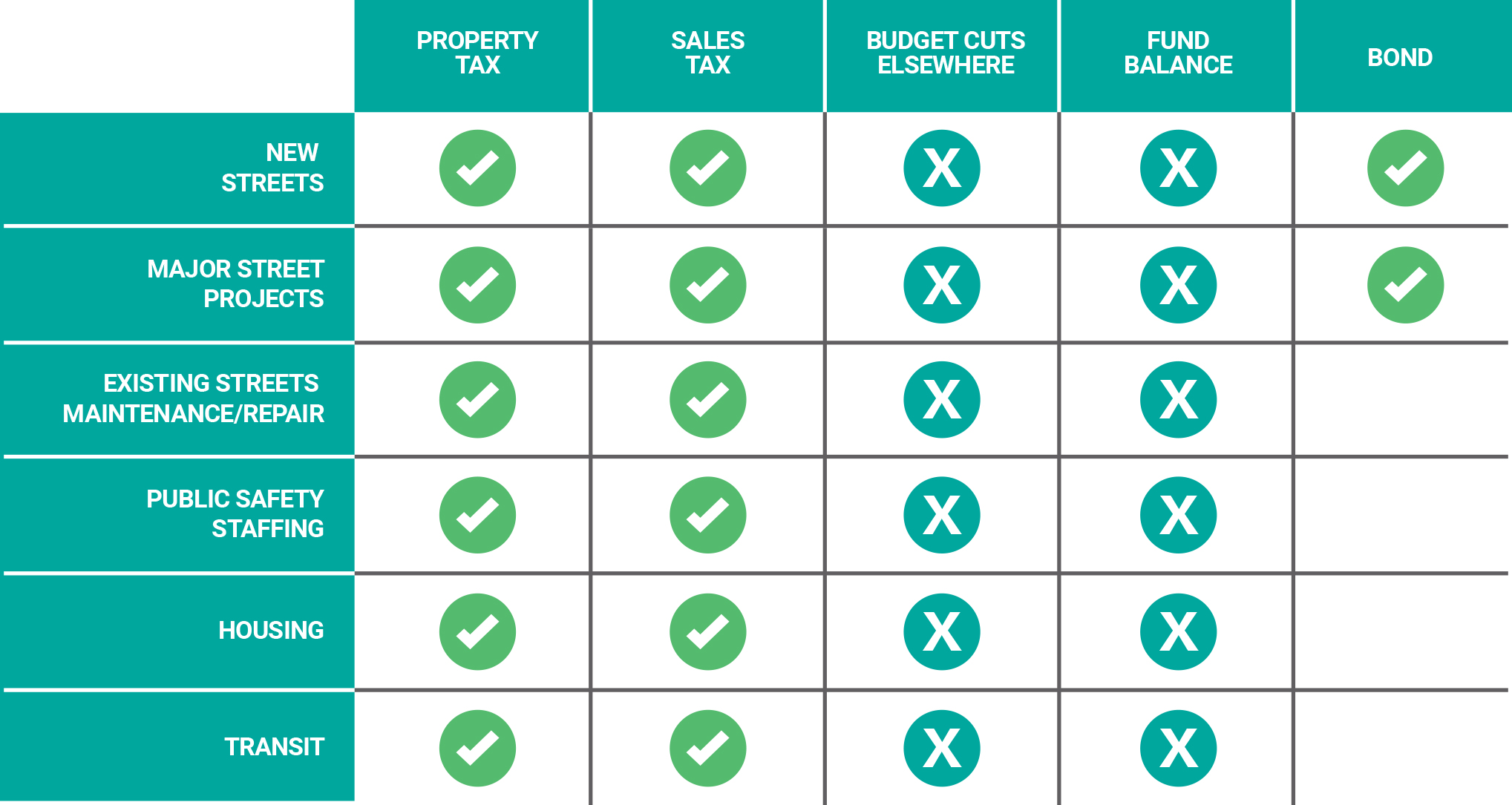

This chart represents the tools that can be used to identify funding for critical city needs of street conditions, housing, transit and public safety:

✔ = indicates that the revenue source can be used for the specific need.

X = indicates that the funding either can’t be used or is limited in that it can only fund specific components of a need.

After considering all available financing options, Salt Lake City officials identified two as the most viable and reasonable – increasing the City’s portion of sales tax and asking voters to consider approving a General Obligation (GO) bond.

When legislators decided to build the new state prison in northwest Salt Lake City, they provided the City with the ability to raise its portion of sales tax by 0.5 percent (or 5 cents on a $10 purchase).

This generates about $33 million a year in additional revenue.

Sales tax is paid on most purchases made in the City (with the exception of groceries and large purchases like cars).

Approximately 60 percent of the sales tax revenue is paid by nonresidents – office workers, visitors and tourists.

Sales tax revenue can be used for ongoing needs such as street maintenance and repair, public safety staffing, funding mechanisms for affordable housing and transit service as follows:

The City Council approved a 0.5 percent increase to the City’s portion of sales tax in May 2018.

Two General Obligation bonds that were approved by voters more than a decade ago to finance the Main Library and The Leonardo will be paid off in mid-2019, providing the opportunity to finance other projects without a large increase in property taxes.

Bond revenue needs to be used for specific one-time projects; in this case, major road and infrastructure projects.

The bond will fund:

Voters in Salt Lake City approved the new $87 million General Obligation bond for Streets Reconstruction projects on November 6, 2018.